Denial Code CO-129 Explained: Causes, Fixes, and Best Practices for Providers

September 8, 2025

Denial code CO-129, also known as Claim Adjustment Reason Code 129 (CARC 129), is a notice from the insurance payer indicating that a claim was denied due to “prior processing information.”

In simpler terms, the payer has already reviewed the claim—or a related one—and the current submission either duplicates or conflicts with that previous decision.

This code doesn’t refer to a specific issue. Instead, it signals that the denial relates to something the payer already processed. As a result, CO-129 can be a frustrating and often misunderstood denial code, particularly for billing teams and providers working to keep claims accurate and moving forward.

Medicare and commercial payers use CO-129 when prior claim activity affects a current submission. For example, if a claim was previously denied for missing documentation and is later resubmitted, the system may issue another denial under this code.

In Medicare, these rejections often result from automated system edits, where prior claim data hasn’t been properly reconciled. On the other hand, commercial plans may apply CO-129 due to internal edits, prior authorizations, or overlapping claims.

At the core of CO-129 is the phrase “prior processing information.” This broad term typically refers to one of the following scenarios:

Resolving CO-129 begins with understanding how the payer handled the original claim. Reviewing that initial processing round is essential to identifying the issue and taking the correct next steps.

Denial Code CO-129 usually feels vague, but it often comes down to errors in how the claim interacts with prior activity in the payer’s system. In case it is a resubmission, correction, or missing from the claim history.

Below are the most common triggers behind this denial:

CO-129 rejection happens when a provider resubmits a previously denied claim without including the required resubmission details. When sending the corrected claim, especially to Medicare or commercial payers, you must include the original claim reference number and use the correct resubmission code. These details help the payer match the new claim with the previous one.

If you leave out this information or if the system cannot find a match between the two claims, the payer will likely deny it again, using the denial code CO-129.

Example:

A provider submits a corrected claim without including the original claim control number. As a result, the payer doesn’t recognize it as a follow-up and treats it as a duplicate or invalid submission, triggering the CO-129 code.

Remark codes (RARC) help explain why a claim was denied or adjusted, giving the payer important context. The payer may not understand your changes if you leave out the correct remark codes or misuse them. In such cases, the system may issue a CO-129 denial as a default response because it can not tell what you fixed or why you are resubmitting the claim.

So, as a provider, you must carefully review the entire claim refiling process. Check all the information you entered on the claim form for accuracy. Most importantly, clearly explain your corrections using the appropriate remark codes. This helps the payer understand your intent and process the claim correctly.

Another primary reason that signals the CO-129 denial code from the payer side is errors in EDI processing.

These errors may include:

Sometimes, a CO-129 denial happens not because of the claim details, but because the patient was not eligible for coverage on the service date.

For example, if a claim references a date of service outside the patient’s coverage period—according to the payer’s records—the system may issue a CO-129 denial. This often happens when the system has already processed related services under different coverage or plan rules.

These types of mismatches often occur when:

Denial Code CO-129 has a consistent definition across payers: the claim is denied due to prior processing information. However, the specific reason behind the denial can vary depending on the payer’s policies and systems.

Understanding how Medicare and commercial insurers handle CO-129 denials enables providers to adjust their billing and resubmission strategies more effectively.

Medicare generally aligns with strict EDI rules, and any deviation, no matter how small, can result in a CO-129 denial. A typical scenario is submitting a corrected claim without using the proper claim frequency code (E.g., 7 for replacement or 8 for void). Medicare treats the claim without that code as duplicate or unrelated, triggering CO-129.

Other Medicare-specific triggers:

Private payers and commercial insurers like Aetna, Cigna, or UnitedHealthcare apply CO-129 differently. Some plans have automated systems that flag inconsistencies between the current and past claim adjudications, even if the prior denial was for minor issues.

Typical triggers with Commercial payers:

Commercial payers are more likely to sue CO-129 as a default denial when their system can not align the current claim with prior processing history. This makes documentation clear, and following their unique resubmission rules is crucial.

Denial Code CO-129 can often feel frustrating because it seems vague, but in most cases, it has a straightforward solution.

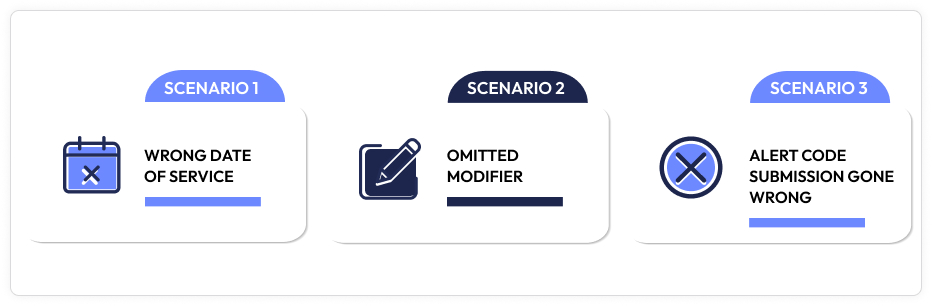

Let’s walk through real-life claim scenarios that commonly trigger this code. By recognizing these patterns, billing teams and providers can quickly identify and correct issues.

Each example highlights how minor oversights can lead to a CO-129 denial—and how to resolve them effectively.

A family medicine practice resubmits a corrected claim after a denial, but the service date is off by one day from the original. They meant to be billed on March 14, but the new claim says March 13.

What Happened: Due to the service date discrepancy, the payer system does not match the resubmitted claim to the provincial. Since there is no recognized link between the two, it triggers CO-129: “claim denied due to prior processing.”

How to fix: Correct the service date to match the original, include the appropriate claim frequency code (7 for replacement), and reference the original claim number.

A specialty clinic bills for a procedure that requires a 25 modifier (e.g., E/M service on the same day as a minor procedure). The original claim was rejected because of a missing modifier. The billing team resubmitted the claim but forgot to add the modifier again.

Why: Because the payer already denied the first claim for a missing modifier, and the resubmission does not fix it, and the claim gets denied under CO-129

How to Fix: Add the missing modifier 25 to the resubmitted claim, verify payer policy for modifier use, and submit as a corrected claim with prior claim reference.

A billing team tries to correct a rejected claim with an Alert remark code (payer-specific notice). Rather than using the actual remark code in the correction, they add a generic placeholder and leave it out entirely.

What Happened: The system does not register the correction as a valid fix because the original reason for denial was not appropriately addressed. CO-129 is returned, effectively saying: This looks like something we already have gone through with.”

How to Fix: Return to the original denial’s remark code, use the same or payer-approved updated code, and ensure all related fields(including resubmission codes) match their rules.

Each of these examples shows how CO-129 is usually not about what is on the claim, but rather what is missing, mismatched, or miscommunicated from prior claim activity. Whether it is a forgotten modifier, a wrong date, or a botched resubmission, CO-129 is the system’s way of saying:

“It does not line up with our prior decision.”

By recognizing these patterns, providers can avoid endless back-and-forth and get claims paid faster.

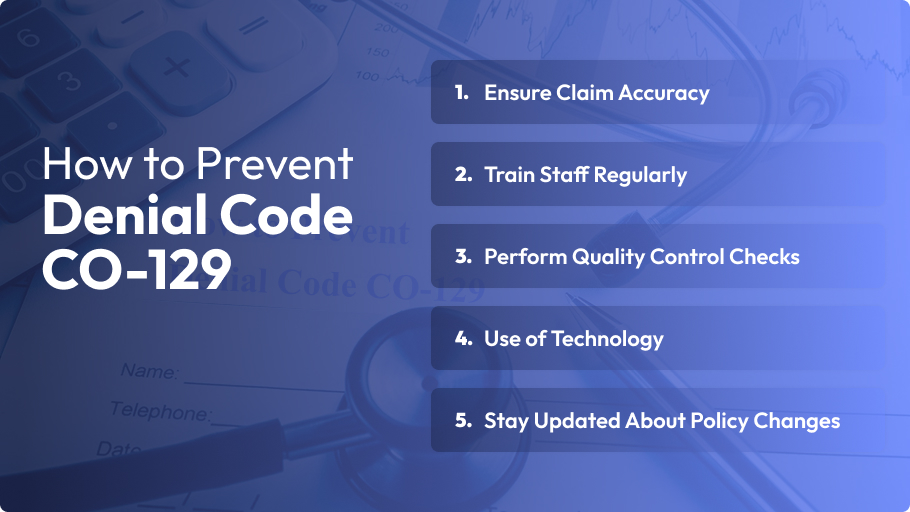

Preventing errors related to Denial Code CO-129 requires understanding the root cause and implementing preventive strategies. By refining the claim submission process, providers can significantly reduce the frequency of these denials.

Understanding how to avoid CO-12 denial code issues is crucial for maintaining effective billing operations and protecting the revenue cycle. Healthcare providers can improve their claims processing and reduce costly denials by adopting and consistently applying these strategies.

When you receive a CO-129 denial, acting quickly and methodically can help get your claim back on track. Follow these steps to correct and resubmit:

Start by carefully reviewing the payer’s remittance advice. The document details why the claim was denied and highlights missing or incorrect information.

Look for any missing or incorrect remark codes associated with the denial. These codes explain the reason for the denial and guide what corrections are needed.

Verify and update the patient eligibility information, CPT codes, and any necessary modifiers. Ensure all documentation matches payer requirements and accurately reflects the services provided.

Consider the appropriate Remittance Advice Remark Codes (RARC) or National Council for Prescription Drug Programs (NCPDC) codes. These codes clarify the claims details and support your corrections.

After assuring corrections, resubmit the claim. Double-check all fields to ensure accuracy and completeness before sending it out to avoid repeated denials.

Sometimes, the denial might still stand even after carefully correcting and resubmitting a claim. When this happens, moving forward with a formal appeal becomes crucial to recovering your payment.

Write a professional appeal letter to the payer’s appeal department. Start by referencing the original claim number and denial code CO-129. Describe the steps you took to correct the claim and why you believe the denial was in error. Be concise but thorough, focusing on facts and documentation that support your case.

Include all relevant supporting documents with your appeal. This usually involves the corrected claims, the original explanation of benefits (EOB) from the payer, medical records, and any correspondence related to the claim. Proper documentation strengthens your appeal and helps the payer understand the legitimacy of your resubmission.

Follow a structured appeals process to increase your chances of overturning the rejection and receiving the payment your practice deserves.

Successfully managing CO-129 denials over time requires a strategic approach centered on prevention, monitoring, and continuous improvement. Here are some best practices to help your practice stay healthy and efficient:

Analyze denial data regularly to identify patterns asd trends specific to each payer. Understanding which payers frequently issue CO-129 denials allows you to tailor your billing and communication practices accordingly.

Organize a structured denial management workflow that outlines the steps for identifying, investigating, correcting, and appealing CO-129 denials. A transparent process improves team efficiency and reduces turnaround time for resolving denied claims.

Use automation tools within your revenue cycle management system to flag claims at risk of receiving CO-129 denials. Automated alerts help your billing team address potential issues before claims are submitted.

If CO-129 denials persist despite your internal efforts, consider outsourcing complex denial management to specialized billing services. Outsourcing brings expertise and resources to handle complex denials more effectively, allowing your team to focus on patient care.

By implementing these best practices, your practice can maintain a strong denial management workflow, optimize revenue cycle management, and minimize the financial impact of CO-129 denials.

Proper and accurate documentation plays a crucial role in preventing CO-129 denials. Payers typically reject claims when documentation is incomplete, inaccurate, or missing key information that validates the billed services. Understanding why payers scrutinize documentation helps providers avoid costly denials.

Insurance payers depend on complete claim documentation to verify medical necessity, coding accuracy, and potential eligibility. When the documentation is unclear or missing vital details, the payer may not validate the claim and will often issue a CO-129 denial requesting corrections or further information.

To avoid this, make sure your claim includes crucial details such as:

Providing this information helps understand the claim’s intent and maximizes processing speed.

Insurance payers depend on detailed and accurate claim documentation to verify medical necessity, correct coding, and patient eligibility. When documentation lacks clarity or contains essential information, payers can not confirm the claim’s validity and often issue a CO-129 denial to request corrections or additional details.

When submitting a claim after a denial, a compliant claim for a physical therapy session should clearly show the patient’s eligibility, the CPT code for the therapy, an ICD-10 diagnosis code linked to the treated condition, any applicable modifiers, and accurate remark codes. Properly documented claims have a much better chance of approval on the first submission.

By prioritizing correct claim documentation, providers strengthen their submissions, meet payer compliance requirements, and significantly reduce the risk of CO-129 denials.

Denial code CO-129 often stems from incomplete or inaccurate documentation, coding errors, or missing payer-required details. However, you can significantly reduce these denials by implementing targeted fixes—such as staff training, pre-submission validation, and thorough claim reviews.

The key to long-term success lies in proactive denial prevention. Tracking trends, building efficient workflows, and leveraging technology will help keep claims cleaner and your revenue cycle running smoothly.

Are you struggling with CO-129 denial challenges?

If so, consider partnering with an expert like Utah Billing Services. Their specialized denial management solutions can help reduce denials and improve your cash flow, allowing you to focus on what matters most: patient care.

What does the denial code CO-129 mean?

CO-129 indicates that a claim was denied due to missing or invalid information, often related to documentation or coding errors. It signals that the payer requires corrections before processing the claim further.

Is CO-129 specific to Medicare?

No, CO-129 is not exclusive to Medicare. While it commonly appears with Medicare claims, many commercial payers and Medicaid programs also use this denial code to flag documentation or coding issues.

Which remark codes usually resolve CO-129?

Remark codes like RARC (Remittance Advice Remark Codes) and NCPDP codes help clarify the reason for a denial and guide corrections, including the appropriate remark codes when resubmitting, which can improve the chances of claim approval.

Can CO-129 be appealed?

You can submit a formal appeal if your corrected claim is still denied. This process involves drafting an appeal letter, attaching supporting documentation, and following the payer’s specific appeals procedures.

How long do I have to correct and resubmit a CO-129 claim?

The timeframe for resubmission varies by payer but typically ranges from 30 to 90 days from the date of denial. Always check the specific payer’s guidelines to avoid missing essential resubmission deadlines.